How Much Money Can I Save?

In 2010, 3.5B was invested into SR&ED by the Canadian government which is up from 3.3B invested in 2009. It was also reported an average 75% of the 18,000 SR&ED claimants in 2009 were small businesses.

According to the Government of Canada, Small Businesses (1 - 99 employees) that innovate spend on average 12.6% of their revenues on R&D.

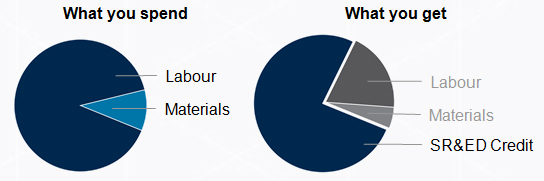

What this means to you: Let's say you have a company with $1.5M in revenue. According to the government, if you are an average company you are investing $189k (12.6%) on innovation. If the project meets the technical criteria for SR&ED, and that 90% of the expenses came from in house staff Salary with the balance in Materials, the potential SR&ED Tax Credit in Manitoba including the provincial SR&ED would be 76% or $144k of the initial $189k.